Rs 2-lakh insurance cover for 3 years for Jan Dhan account holders on cards

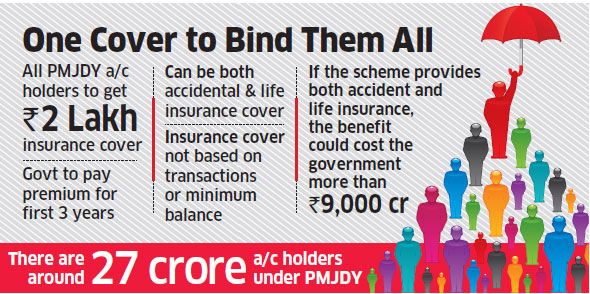

The government is considering an umbrella insurance scheme under which all Pradhan Mantri Jan Dhan Yojana (PMJDY) account holders will be offered free Rs 2-lakh insurance cover for three years amid a broader push to create a robust social security net for the poor.

There are about 27 crore account holders under the PMJDY fiscal inclusion scheme. Of these, 16 crore have been seeded with Aadhaar numbers, ensuring that welfare payments reach their intended beneficiaries.

The government launched three social security programmes in 2014 — the Pradhan Mantri Suraksha Bima Yojana (PMSBY), the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and the Atal Pension Yojana (APY) — to bring the poor into the fold of formal financial services. According to finance ministry data, 3.06 crore people have been enrolled under PMJJBY and 9.72 crore under PMSBY. Insurance penetration — the proportion of premiums to GDP — is low; it was 3.44% in 2015. The life insurance cover under PMJJBY is available for an upfront premium payment of Rs 330.

Accidental insurance under (PMSBY) costs Rs 12 annually and covers accidental death and disability.

In both cases, the policyholder is eligible for a benefit of Rs 2 lakh. “The government can bear the premium cost for both life and accidental insurance scheme. The general insurance scheme can be immediately offered to all Jan Dhan account holders,” said the official cited above.

The other option is that the scheme is structured along the lines of APY, with the government cocontributing 50% of the total premium or Rs 1,000 per year, whichever is lower, to each eligible subscriber for a period of five years till 2019-20.

“Banks have already been directed to educate Jan Dhan account holders about the existing social schemes,” said the official, adding that since some money has come into these accounts after demonetisation, holders can be persuaded to buy basic insurance cover. So far, 44,720 claims have been registered under PMJJBY, of which 40,375 have been paid out. Of the 8,821claims under PMSBY, 5,878 have been paid.

ET View

Centre Must Pick Up Tab

The government’s intent is laudable, given that even one health emergency can push a family back into abject poverty. The Centre must foot the bill for these account holders in its entirety. Premiums should cover actuarial costs to enable insurers underwrite the business. Both the Centre and the states must also focus on preventive public health care such as providing clean drinking water and sanitary disposal of sewage. The case to increase government spending on healthcare is compelling.

TAG : #EkVaatKau #JanDhanYojana #Insurance

TAG : #EkVaatKau #JanDhanYojana #Insurance

No comments:

Post a Comment

Please Comment Your Questions, Queries or Suggestions